oklahoma car sales tax rate

The Motor Vehicle Excise Tax on a new vehicle sale is 325. This is the total of state county and city sales tax rates.

When Is Tax Free Weekend In Arkansas And Oklahoma

An example of an item that exempt from Oklahoma is prescription medication.

. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4264 on top of the state tax. Advantages of the motor vehicle tax are. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11 Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

325 percent of the purchase price. What is the sales tax rate in Oklahoma City Oklahoma. Motor Vehicle CARS - Online Renewal Find a Tag Agent Forms Publications Specialty License Plates Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption.

That must be added to the city tax and the State Tax. 20 on the first 1500 plus 325 percent on the remainder. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. How Much Is the Car Sales Tax in Oklahoma. The County sales tax rate is.

How to Calculate Oklahoma Sales Tax on a New Car. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. This is also in addition to the State Tax Rate of 45.

The Tulsa sales tax rate is. Ad Find Out Sales Tax Rates For Free. In Oklahoma localities are allowed to collect local sales taxes of up to 200 in addition to the Oklahoma state sales tax.

The state sales tax rate in Oklahoma is 4500. The maximum local tax rate allowed by Oklahoma law is 65. Wayfair Inc affect Oklahoma.

Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax you will pay on your new purchase. The County sales tax rate is. Oklahoma has recent rate changes Thu Jul 01 2021.

Used vehicles are taxed a flat fee of 20 on the first 1500 of the purchase price and the standard 45 combined tax rate for the remainder of. The Sallisaw sales tax rate is. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

Select the Oklahoma city from the list of popular cities below to see its current sales tax rate. 325 percent of the manufacturers original retail selling price. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

Fast Easy Tax Solutions. There are a total of 356 local tax jurisdictions across the state collecting an average local tax of 3205. Did South Dakota v.

Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from 035 to 7 across the state with an average local tax of 4264 for a total of 8764 when combined with the state sales tax. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Denotes Use Tax is due for sales in this city or county from out-of-state at the same rate as shown. There are a total of 470 local tax jurisdictions across the state. The state sales tax rate in Oklahoma is 4500.

The Oklahoma sales tax rate is currently. If used to finance roads and other transportation which is only partly the case in Oklahoma it can match payment for service to the benefit from the service. This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but.

The minimum combined 2022 sales tax rate for Sallisaw Oklahoma is. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. What is the sales tax in Oklahoma 2021.

Oklahoma OK Sales Tax Rates by City Oklahoma OK Sales Tax Rates by City The state sales tax rate in Oklahoma is 4500. 125 sales tax and 325 excise tax for a total 45 tax rate. Did South Dakota v.

This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. Oklahoma charges two taxes for the purchase of new motor vehicles. This is the total of state county and city sales tax rates.

Average Sales Tax With Local. As of July 1 2017 Oklahoma charges a 125 percent sales tax on vehicle purchases in addition to motor vehicle taxes. Oklahoma also has a vehicle excise tax as follows.

As of July 1 2017 Oklahoma. Used boats and boat motors. The Oklahoma sales tax rate is currently.

Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. New boats and boat motors. 325 percent of the taxable value which.

Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax. The minimum combined 2022 sales tax rate for Oklahoma City Oklahoma is. The 2018 United States Supreme Court decision in South Dakota v.

The County sales tax rate is. Did South Dakota v. This is the total of state county and city sales tax rates.

609 rows 2022 List of Oklahoma Local Sales Tax Rates. With local taxes the total sales tax rate is between 4500 and 11500. Most vehicles all terrain vehicles boats or outboard motors are assessed excise tax on the basis of their purchase price provided that purchase price is within 20 of the average retail value for that specific model.

There are special tax rates and conditions for used vehicles which we will cover later. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. 2021 List of Oklahoma Local Sales Tax Rates.

The Oklahoma City sales tax rate is. States with some of the highest sales tax on cars include. The Oklahoma sales tax rate is currently.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

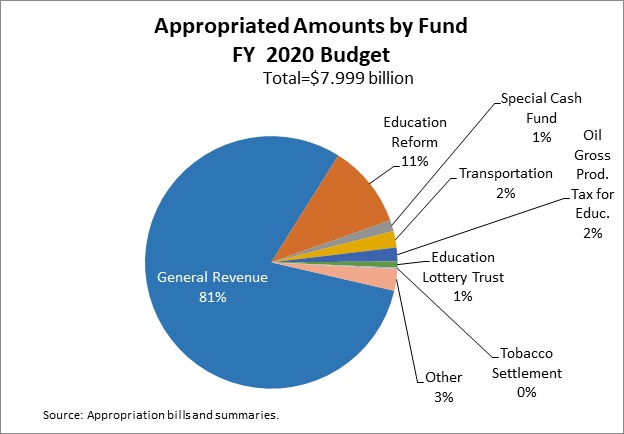

Limits On The Budget Oklahoma Policy Institute

Volvo Vehicles Enterprise Car Sales

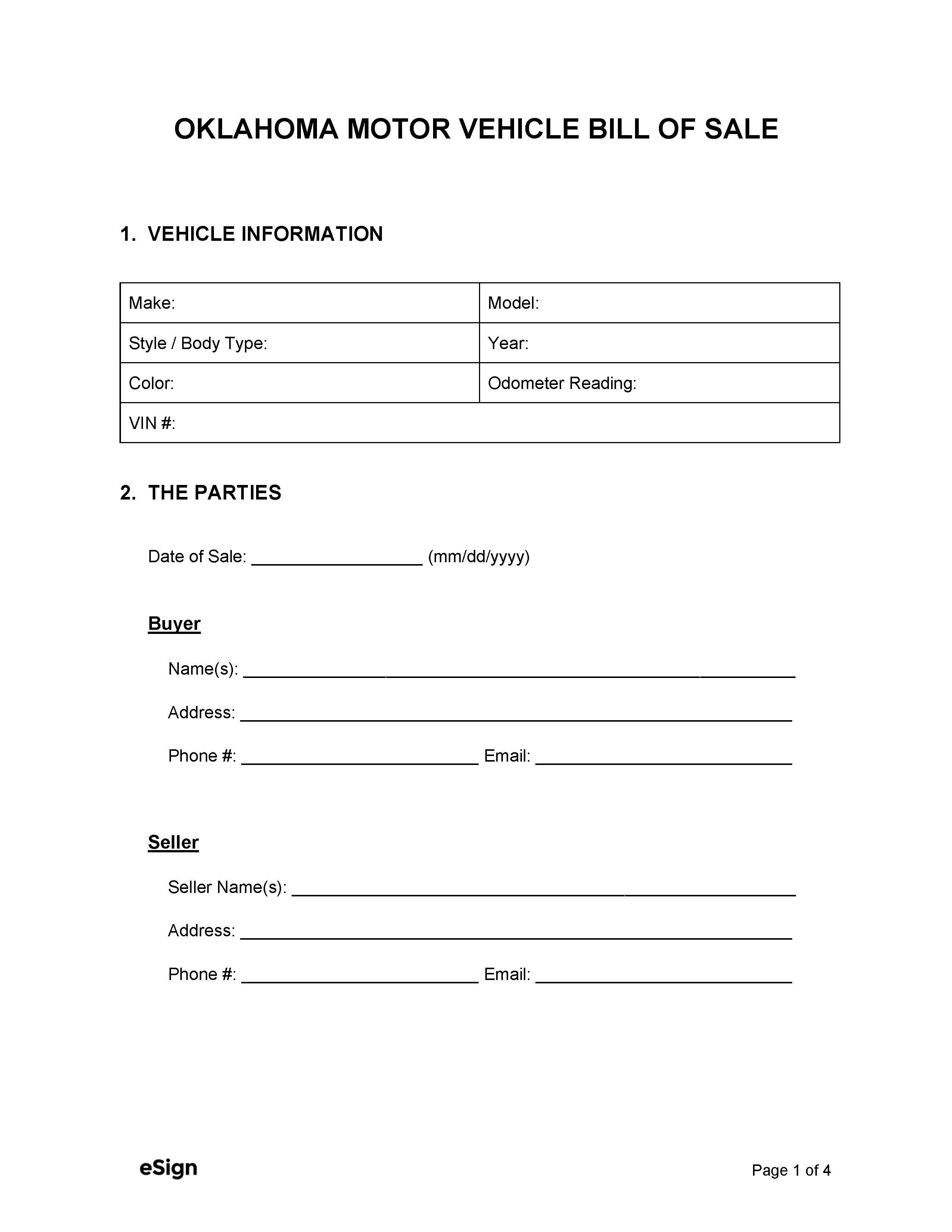

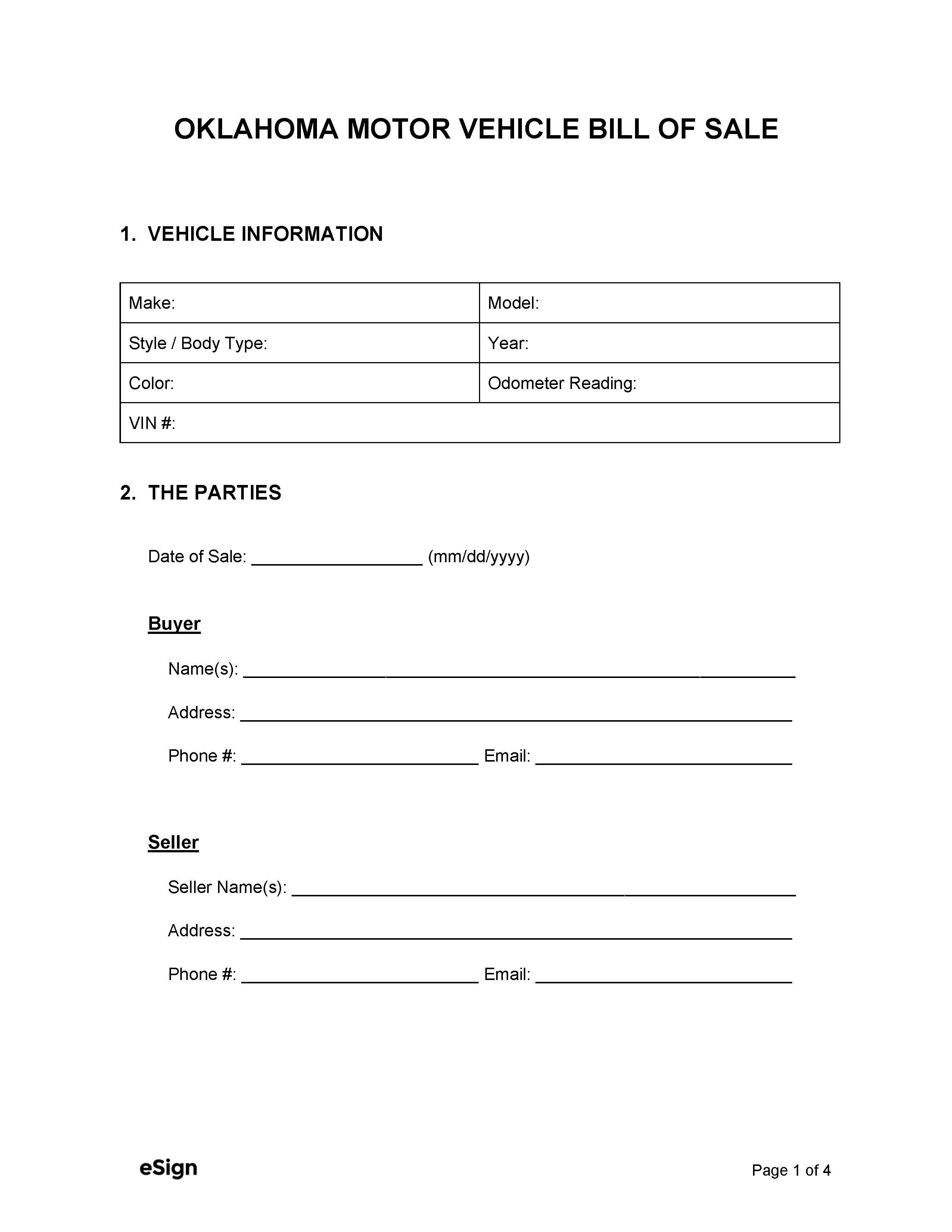

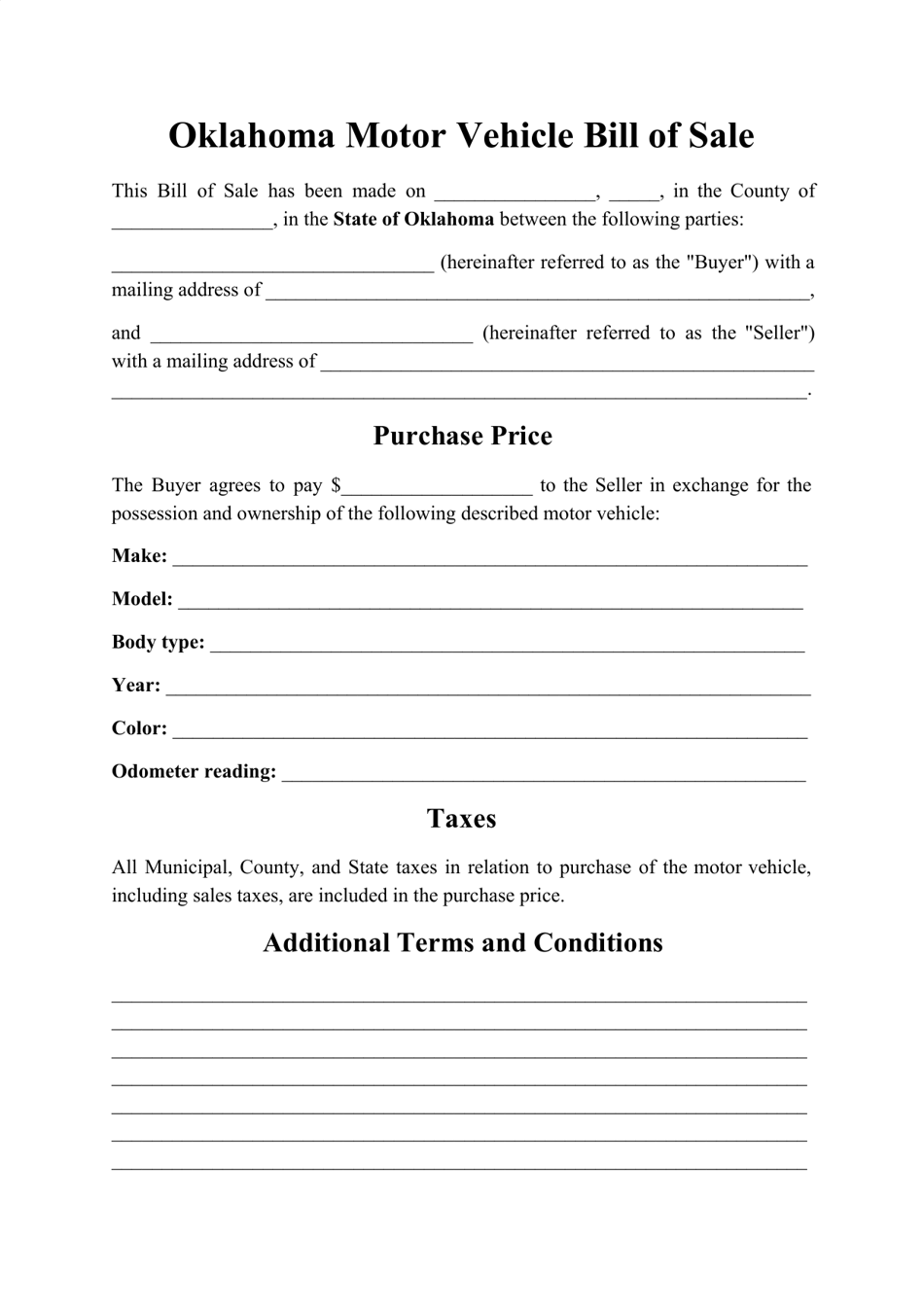

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Honda Accord Sedan Vehicles Enterprise Car Sales

Oklahoma Sales Tax Rates By City County 2022

Iowa Sales Tax Small Business Guide Truic

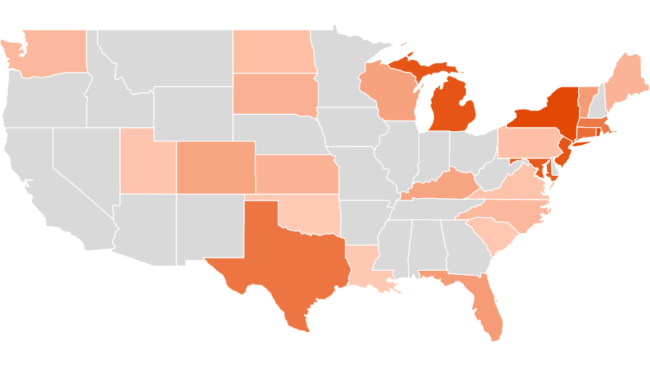

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Oklahoma Senate Leader Dismisses House Tax Cuts As Political Theater

Seminole Nation S Attempt To Tax Oil Companies Prompts Swift Response From Hunter Stitt

Oklahoma Senate Leader Dismisses House Tax Cuts As Political Theater

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller